KROO BANK 2023

Interest Calculator

How might we better explain Kroo's interest rate and communicate its benefit to drive customer deposits, whilst reducing customer support tickets?

Kroo is a UK digital bank on a mission to change banking for good. A bank that gives back to you, your friends, and the planet.

Background

Kroo’s interest calculator webpage turned into quite a passion project of mine. It was my proudest achievement whilst working at Kroo for three main reasons:

-

Leading a project end-to-end: I proactively took ownership of and led the project—and later co-led with the Web Tech Lead—end-to-end. From conducting the initial research, proposing the idea of a calculator, designing and testing the solution, to seeing it through to development.

-

2-in-1 solution: It was a project born out of genuine customer and business need, and resulted in a solution that exceeded expectations for both. It’s not often that a solution meets both needs without some compromise.

-

Complex design problem: Owing to the complexities around calculating interest and the differences that can occur amongst interest offerings (e.g. monthly vs. annual compounding, daily vs. monthly calculations, variance in number of days in the month), it was highly challenging to translate into a clear and interactive solution. It was therefore extremely rewarding to see it come to fruition. You won't find an interest calculator like it elsewhere!

Summary

Kroo previously operated a pre-paid card account and had just launched its successor product in December 2022: a high-interest-bearing current account with 2% AER. This project centred around optimising the high-interest rate offering and turning financial jargon into something meaningful and tangible to new and existing customers.

Challenges and constraints

-

Not on the roadmap: The interest calculator was reactive and came about as the result of Kroo's new high-interest rate USP and demand from Customer Support—something the roadmap didn't account for. Owing to this, the feature was not owned by a Product team. I had to assume ownership and navigate an unfamiliar product process to drive it forward.

-

New website: The Web Lead was a one-man band rebuilding Kroo's entire website from scratch. While the calculator page was relatively quick to build, the wider website transition slowed things down.

-

Highly complicated: This was possibly one of the most complicated things to design in the context of retail banking. I’d set myself an extremely ambitious task without realising it, and quickly learnt why a calculator like this (an interest calculator emphasising financial education) probably didn't exist previously.

-

Future-proofing: Owing to the above, the project took about ~9 months from design to implementation. In that time, Kroo changed their interest rate four times. We had to take this variability into account by ensuring the design and build was as future-proof as possible, such as having variables coded as values in the copy. We needed to avoid manually updating everything when the rate changed.

Context

Key contributors:

-

Product Designer (Me; previously Product Researcher)

-

Web Tech Lead

There were many others involved in the birth and fine-tuning of this project such as the Product Manager and wider Design & Research team, but the Web Lead and I drove it forward to execution.

Time span: Jan 2023 — Oct 2023 (with lots of challenges along the way!)

Problem

It had been a month or so since the launch of Kroo’s current account and the deposits weren’t soaring as the company was expecting. Most current accounts on the market during Dec—Jan ‘23 offered zero interest, so, naturally, Kroo thought their 2% AER would be turning heads. There were now plans to increase the rate to 3.03%. This time, however, the CPDO approached the Design & Research team with a brief to design an in-app solution to leverage the rate. We sought to solve the following:

How might we optimise Kroo’s 3.03% AER offering to drive deposits?

The quick-wins that emerged from the workshop were making interest tangible and increasing financial literacy.

Workshop and previous research

The Lead Product Designer organised a workshop for the team to reflect on the problem space, where I presented a summary of primary insights we had to date. Having previously conducted the research with the User Researcher and having just made the move from Research to Design myself, the insights were fresh in my mind and I had a concrete understanding of how they could inform the problem at hand.

The insights came from two survey research projects that were conducted in the run up to the current account launch. They had a sample of 100-120 respondents in each based on the characteristics of our prospective current account customers. The objective was to understand the likelihood and potential barriers around customers switching to and depositing their savings in a high-interest-bearing current account (of course, as with any hypothetical self-reporting measures, we take this with a pinch of salt).

Both surveys revealed parallel barriers to depositing savings and current account acquisition based on high interest rates. At the time, 50-56% weren't looking for better interest rates on their current account. This was due to the following:

-

Low balances mean it's not worthwhile

-

Passivity towards interest rates on current accounts (as opposed to savings accounts)

-

Lack of understanding

We recommended that Kroo focus on factors within their control, namely helping increase customers' understanding of interest rates and instilling FOMO (highlighted in pink).

Heading back to Figjam and armed with this knowledge, the team then ideated concepts and goals for what we thought Kroo should or could do to leverage the interest rate. We grouped these into priorities of Must-Dos and Would-Love-to-Dos, as shown in the images below. The main quick-wins that emerged were making interest tangible and increasing financial literacy.

We then ideated potential in-app solutions as per the brief, Crazy 8 style. Each team member pitched their ideas and we voted on which ones we thought were most original, feasible and suitable.

I presented the idea of an interest calculator which ended up receiving the most votes overall.

It was time to get designing!

Design

Mapping the journey

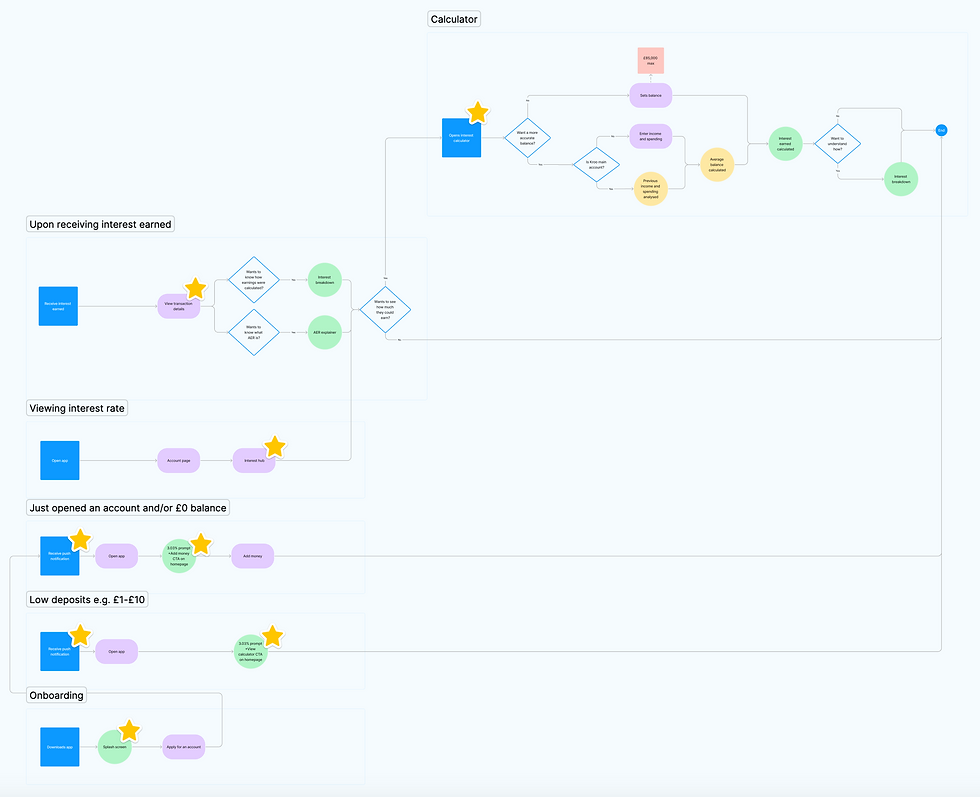

Because I had worked so closely on the research, the business and customer needs were well- ingrained in me at this point and I was able to confidently transfer this knowledge during the design phase. I started considering the most optimal solution for the interest calculator, which encompassed the holistic interest journey from onboarding to depositing money, rather than simply an interest calculator in isolation. This was important as, since the launch of the current account, the focus had been implementing a functioning interest system in the backend, meaning the customer-facing app journey had been neglected. I mapped the flow of what this journey could look like, identifying every point of contact customers currently had with the interest rate, where additional points could be added, alongside potential entry points to the calculator (see image below).

Mapping the full interest journey allowed me to reflect upon what Kroo were currently doing and how an interest calculator could fit in. *Stars indicate customer points of contact with the interest rate.

This journey progressed into an idea for an interest ‘hub’, where customers could view their total accrued interest and calculate their potential earnings. This would help make interest tangible and hopefully instill FOMO (see images below).

The initial in-app interest hub idea and entry point to the calculator

I considered how customers' contact with the interest rate would differ throughout the different stages of their journey, such as providing instant confirmation and reassurance on the homescreen upon opening an account.

Defining the scope

Despite this being an ideal solution and having even obtained buy-in from the CEO, the reality was that developing a feature like this was not a priority and Kroo simply did not have the engineering resource. There was a lot that needed to be prioritised from a financial product and regulatory standpoint given Kroo had just launched their current account. Understandably, the experience enhancers had to be sidelined. Instead, the Product Manager and I prioritised simply showing the interest rate in-app as the MVP (see first screen above). This was supported by a high number of customers requesting confirmation that they were earning interest .

Since an in-app calculator was no longer an option, I turned to the website. Kroo’s high interest rate wasn't going to be around forever and there was currently nothing leveraging this, so I was keen to find a way to implement it. A web solution ended up being a better business solution overall since it could target prospective customers to drive conversion, as well as existing customers. Luckily our first web developer had just joined Kroo, so I approached him about the project to get him onboard. He already had a lot of anticipated work as he planned to rebuild the website from scratch, so we discussed where the calculator could fit in. This helped manage my expectations as I knew it wasn’t going to happen overnight but I knew it was going to happen at some point. Hurrah!

Ideation

It was time to tackle the design of the web interest calculator. I started by conducting competitor research on existing interest calculators. The key takeaways were:

From the competitor analysis, I deduced there was opportunity space for Kroo to provide a comprehensive interest calculator. Other banks either failed to provide calculators with sufficient breakdowns and explanations or didn't provide them at all. Existing calculators were also either savings-based or only showed gross interest earnings. Kroo's would fill the gap and aid customer understanding by showing AER earnings based on daily calculations and monthly compounding.

I took my initial in-app calculator ideas and experimented to see how these would look on web. We already had an existing web overdraft calculator so I used this as a sibling component to work from.

Click through to view concepts

I generated multiple concepts in an attempt to show and explain

something so complicated, using as minimum content as possible

This was quite possibly one of the most complicated things to design. The more I explored, the more questions were raised, and the more scenarios and edge cases I had to account for (which is probably why this type of interest calculator didn't exist!). I didn't want to give up and finish with something that was mediocre and just like the competitor calculators. This would have defeated the point. I persevered until we had the best solution with its own USPs under the existing constraints.

Sudden business demand

Then, the Martin Lewis Money Show happened. Martin Lewis (financial guru and second most popular TV star in Britain) announced Kroo's rate hike from 2% to 3.03% AER and called this the 'best open-to-all easy-access savings with unlimited withdrawals since 2012'. The week following this announcement, our customer base soared from 150 new accounts per day to 1,731 per day. Operationally, it was a bit of a nightmare.

This was later coined the ‘Martin Lewis effect’ and challenged our theory around barriers towards acquisition. A lack of understanding showed not to be a problem for acquisition. This was because those who don’t understand money, will look to someone who does. They’ll do what a Money Saving Expert tells them to do.

Martin Lewis quoting Kroo as "the best open-to-all easy access savings with unlimited withdrawals seen since 2012"

However, unlike acquisition, a lack of understanding did show to be a huge problem for another area of the business. It was manifested through an unmanageable influx of customer support tickets (and tweets), with customers questioning and disputing their first interest payments. Our recommendation to help improve customers' understanding of interest was vindicated for existing customers. The interest calculator was suddenly highly desirable by the business.

'aka James Bond' even threatened to report us to the FCA

Revising the problem statement

I factored in the above events to expand and reframe the problem statement.

Problem statement: How might we better explain Kroo's interest rate and communicate its benefit to drive customer deposits, whilst reducing customer support tickets?

The main objectives were now to:

-

help existing customers to gauge their potential earnings so they’re motivated to move their money to Kroo,

-

help existing customers to understand what interest they’re getting each month, and

-

help Customer Support (CS) to answer interest-related queries.

The latter emerged as it became apparent CS were using a handmade spreadsheet to calculate interest for customers. As well as this not accounting for edge cases or explaining how the interest was calculated, the formulas were at risk of being tampered with!

Additionally, a by-product benefit that emerged was retention. Kroo’s mission is to be trusted and loved and this solution presented the perfect opportunity to demonstrate our intent to be transparent and support customers' financial literacy.

Testing

Approach

After many Design, Product, Compliance and copy reviews, I had a web page that was ready to be tested. I intentionally delayed testing as it was important that the calculator and its written breakdown was communicated as clearly as possible, since we would be testing understanding rather than usability. I deliberated with the Research team about the approach as, in order to get as reliable results as possible, we needed an audience that was motivated to use an interest calculator. We decided against recruiting our usual panel from UserTesting.com, as this would be hard to screen for and the panel wouldn’t have fully understood the context of the calculator (Kroo’s offering and proposition).

On the other hand, an audience that did have a genuine motivation to understand how Kroo’s interest rate and earnings worked, was Kroo's CS team. They had the closest direct contact with our customers and were using a calculator of their own as an internal tool. I approached the CS managers and together we arranged unmoderated testing sessions with six CS agents.

Test plan

The main objectives of the testing were to:

-

understand the most common interest-related customer queries to ensure the webpage accounted for these, and

-

understand whether the calculator and FAQs were clear, easy to use, and easy to understand.

Testers were asked to self-rate their understanding of interest rates prior to the test so we could account for this in the results. They were then presented with a prototype and series of 10 short tasks and questions.

Results

Overall, the interest calculator was perceived as being simple, easy to understand, and easy to use. Testers found the breakdown personally helpful as it showed a clear formula for calculating interest, rather than simply producing earning figures in isolation. Testers even eagerly expressed for this to be a first port-of-call with customers to relieve CS capacity. Very encouraging!

Positives:

-

6/6 testers instinctively scrolled and easily located the breakdown.

-

Testers liked the option to switch between monthly and annual breakdown.

-

Testers liked that it would provide customers the freedom to work out interest earnings for themselves:

-

The daily breakdown of interest accrued was clear and easy to follow. Freedom to take their balance and multiply it by X days or months that suit them.

-

Customers want certainty that CS can't provide them. CS don't feel comfortable telling customers 'you will earn X amount this month' as this is dependent on their income and outgoings. The calculator therefore provides a self-serve tool for customers to gauge an estimate for themselves.

-

-

Feedback was that information was clear and FAQs were sufficient.

Considerations and areas to improve:

Have a play with the prototype below

Issues | Suggestions based on ease and impact |

|---|---|

______________________________________________________ Calculator: No one pressed the anchor link from the balance in the breakdown. However, this didn’t seem to be an issue, as they realised the breakdown reflected the balance that was inputted in the calculator. | Could make the anchor link look more ‘tappable’ but not a high-priority change as not a major usability concern. |

Interest and earnings breakdown could be clearer: We show 30 and 31 days in the breakdown to demonstrate different months, but it might help to include 28 days to reflect how earnings would look in February. | Fair point but there aren't three consecutive months comprising of 28, 30, and 31 days. Could allow users to reveal more months on-click rather than being restricted to three. |

Interest and earnings breakdown could be clearer:

Provide examples of the month, e.g. Jan - 31 days, Feb - 28 days, as ‘1st month’ ‘2nd month’ isn't immediately clear.

| Adding the months is a quick and easy change that will increase understanding and also help to make it more ‘human’. |

FAQS: No interest rate history for customers

to view previous rates. | Excellent point and real use case here for customers wanting to back-date calculations. This could be easily added as another FAQ showing previous interest rates and time frames. |

I implemented the last three suggestions above and made sure to keep COps updated on when the page was anticipated to go live. The testing process was really valuable and I continued to engage them with the calculator's development. The Web Lead and I shared the development site with COps in the meantime as they were keen to use it as an internal tool straightaway. I recognised that COps can often feel out-of-the-loop when it comes to product and feature updates, despite being in contact with hundreds of our customers on a daily basis. I've since made more of a conscious effort to communicate and share other work with them when relevant, so they have more visibility over what's happening behind the scenes.

Final outcome

You can see the live webpage and final outcome here. All in all, I was extremely pleased with the outcome of this project. Seeing my blue-sky thinking through to fruition and leading a project end-to-end was a personal achievement. I was very lucky to be joined by the Web Lead, too. If it wasn't for him, the calculator wouldn't have been built!

Impact

Tracking metrics hadn't been implemented within the new website build at the time, but a KPI would have been tracking conversion through the number of 'Join Kroo' sign up clicks. The calculator also served as an invaluable tool internally for COps. They had been desperately fumbling around with a crude spreadsheet; so having a legitimate, trialled and tested calculator was a blessing for them. It's not often a product can end up serving both customer and internal business need.

In addition, the interest calculator exceeded requirements for the recently introduced Consumer Duty regulation (FCA regulation to meet a higher standard of consumer protection), since it's sole function centred around helping to increase customers' financial understanding of interest. The Compliance team had no problems approving it (win!). This puts Kroo in good stead and hopefully on the radar for awards such as those honoured by Fairer Finance.

Reflection

What went well

-

Leading a project: I proposed and took ownership of an idea outside of the roadmap and drove it to development. Because other stakeholders could see real value in it, I didn't receive pushback for doing so. I went beyond the expected responsibilities of a designer by kick-starting and managing the product process. With guidance from product experts, I had to assume similar responsibilities to a PM in terms of documentation, risk assessment, and seeking wider sign-off and approval. I understood that, by not taking ownership, the idea would be shelved and Kroo would miss the opportunity to leverage their USP. There was no knowing how long Kroo’s high interest rate would last. I needed to involve the right people in order to make it happen.

-

Collaborating with developers early on: Approaching the new Web Lead early on was one of the best things I could have done. Straight away, he was able to elaborate on technical constraints (such as the input field) and I was able to account for this during the design phase. I shared my progress continuously and checked design feasibility with him throughout. This avoided any potential nasty surprises for him at the end. Getting him onboard early also meant he was able to make a start on the build and have something tangible to show stakeholders when seeking approval.

-

Stakeholder buy-in: Although I ended up working with the Web team on the solution, I presented my designs at bi-weekly Show and Tells to get technical feedback from developers, product managers, and Compliance early on. This was important in helping to prevent blockers further down the line as it ensured stakeholders were engaged and wouldn’t be seeing it for the first time when sign-off and approval was needed.

Learnings

- Being in a PM's shoes: I learnt a lot about the internal product process and how messy it can be for PMs. Processes and priorities are often changing and so not always clear, especially at a start-up. I was able to empathise more with them and appreciate why design solutions need to be stripped down to a bare MVP a lot of the time. This deeper understanding has since helped encourage a smoother collaboration.

- Involving senior stakeholders: Although pursuing this project was a worthwhile learning experience, my lack of awareness of formal processes at the start meant there was some back-and-forth with senior stakeholders towards the end of the design phase. Next time I would approach more senior stakeholders, such as the Head of Product, earlier on.

- Walk before running: As well as learning about the importance of getting the more senior people onboard early on, I also learnt that it's important to take a step back before diving into a project. While my naïve optimism worked in my favour by demonstrating proactiveness beyond that expected of a designer of my level at the time - the Head of Product congratulated my perseverance in taking blue-sky thinking to the next level - it did mean I'd almost bitten off more than I could chew. Next time I would try to get a fuller understanding of the scope of a project and understand the potential impact that owning a big project would have on my wider workload.